Picture this: your company is ready to fly high on the wings of an Initial Public Offering, ready to be tossed and turned in the exhilarating whirlwind of Wall Street. But beneath the veneer of excitement, you sense a powerful dread. Nerve-racking hours, bales of paperwork, and unfamiliar terrains of securities law loom in the near distance. Yet, you must tread lightly, without ruffling the dignified feathers of your faithful investors. Welcome, intrepid entrepreneur, to the tightrope walk of navigating an IPO without succumbing to its many trials and tribulations. Behold, your guide to threading the needle, to adroitly pirouetting between meeting your obligations and maintaining investor delight. Prepare to journey through an enchanting tapestry of insider tips, clever alternatives, and well-kept secrets on how to avoid all the IPO work without aggravating the apple cart of investor relations.

Table of Contents

- Streamline the IPO Process for Investors’ Peace of Mind

- Focus on Pre-IPO Capital Raising Strategies

- Leverage Private Markets for Funding Success

- Implement Efficient Communication Channels for Transparency and Investor Relations

- Final Thoughts

Streamline the IPO Process for Investors’ Peace of Mind

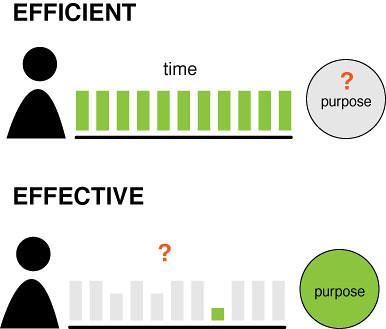

Investing in initial public offerings (IPOs) can be a risky endeavor, but it doesn’t have to be a stressful one. By streamlining the IPO process, investors can have peace of mind knowing that their investments are being handled efficiently and effectively. One way to avoid all the work associated with IPOs is by utilizing automated investment platforms that do all the heavy lifting for you.

These platforms use algorithms to analyze market data and identify promising IPO opportunities. They can also help investors build a diversified portfolio of IPO stocks, reducing the risk of putting all their eggs in one basket. By taking advantage of these tools, investors can save time and energy while still reaping the potential rewards of investing in IPOs.

Another way to simplify the IPO process is by working with a trusted financial advisor who specializes in IPO investing. These professionals have the expertise and experience to guide investors through the process, helping them make informed decisions and avoid common pitfalls. By partnering with a knowledgeable advisor, investors can navigate the complexities of the IPO market with confidence and peace of mind.

Focus on Pre-IPO Capital Raising Strategies

In today’s competitive market, companies are constantly looking for ways to raise capital before going public. One effective strategy that many businesses are turning to is pre-IPO capital raising. By securing funding before the initial public offering (IPO) process begins, companies can avoid the time-consuming and often complex tasks associated with preparing for a public listing.

One key benefit of focusing on pre-IPO capital raising is the ability to attract investors who are looking to get in on the ground floor of a promising opportunity. By offering shares at a lower price than what they may eventually be valued at post-IPO, companies can entice early investors and build excitement surrounding their upcoming public offering. This approach can help generate momentum and interest in the company, setting the stage for a successful IPO.

Utilizing creative financing options, such as convertible notes, venture debt, or strategic partnerships, can also help companies raise capital without diluting existing ownership. By thinking outside the box and exploring alternative funding sources, companies can secure the funds they need to fuel growth and expansion, all while keeping their investors happy and engaged.

Leverage Private Markets for Funding Success

Looking to secure funding without going the traditional IPO route? Private markets can offer a viable alternative, allowing companies to raise capital without the hassle of going public. By leveraging private markets, businesses can access a diverse range of investors, from venture capitalists to private equity firms, who are looking to invest in promising opportunities.

One key advantage of raising funds through private markets is the ability to maintain more control over the company’s direction and operations. Unlike with an IPO, where shareholders have a say in decision-making processes, private funding allows businesses to retain autonomy and focus on long-term growth strategies. This can be especially appealing for entrepreneurs who want to avoid shareholder pressure and short-term profit demands.

Moreover, by tapping into private markets for funding, companies can benefit from a more efficient fundraising process. With fewer regulatory requirements and disclosure obligations compared to going public, businesses can save valuable time and resources while still attracting the capital needed for expansion. This streamlined approach can help companies avoid the complexities and costs associated with an IPO while still accessing the funding necessary for success.

Implement Efficient Communication Channels for Transparency and Investor Relations

In today’s fast-paced business world, efficient communication channels are crucial for maintaining transparency and strong investor relations. By implementing streamlined methods of communication, companies can effectively engage with investors and provide them with the information they need to make informed decisions. This not only helps build trust and credibility but also ensures that investors are more likely to stay engaged and supportive.

One way to enhance communication channels is by utilizing various digital tools and platforms. Email newsletters, social media updates, and investor portals can all be effective ways to keep investors informed about company news, financial updates, and upcoming events. By leveraging these channels, companies can reach a wider audience and ensure that important information is easily accessible to all stakeholders.

Moreover, regular communication through these channels can also help mitigate any potential issues that may arise during the IPO process. By keeping investors informed and engaged throughout the journey, companies can minimize the risk of misunderstandings or conflicts. This proactive approach not only saves time and resources but also demonstrates to investors that their interests are a top priority. By investing in efficient communication channels, companies can foster strong investor relationships and achieve greater success in the long run.

Final Thoughts

In conclusion, navigating the world of IPOs can be a daunting task for both companies and investors. By following some simple tips and tricks, you can avoid the excess work without turning off potential investors. Remember to prioritize communication, transparency, and flexibility throughout the process to ensure a smooth and successful IPO experience. By finding the balance between showcasing your company’s value and respecting investor’s time, you can create a win-win situation for everyone involved. Good luck on your IPO journey!