In the diverse, digital forest of cyberspace, amidst the rustling e-trees and chirping tweets, stands the whispering giant – Reddit. The democratic haven of keyboard dwellers, the Oxford Street of meme retail, and the campfire for storytelling from the edges of the world. While its roots have twined into the internet’s folklore, Reddit’s branches have far to reach in the real world of finances. As Wall Street’s gaze lingers upon it, the looming question becomes – Can Reddit withstand the atmospheric change of its own Initial Public Offering (IPO)? Hold on to your clickers, netizens, as we delve into the potential ramifications of this daring venture.

Table of Contents

- Understanding the Potential Impact of Reddit’s IPO

- An In-Depth Look at Reddit’s Financial Health Pre-IPO

- Reddit’s IPO: Challenges on the Horizon

- Considering Community Reaction to Reddit’s IPO

- Strategies for Reddit to Sustain and Thrive Post-IPO

- The Conclusion

Understanding the Potential Impact of Reddit’s IPO

The notion of Reddit going public via an Initial Public Offering (IPO) brings forth both great potential and inherent risks for the company. On one hand, it allows Reddit to leverage more capital from stock sales, facilitating growth and further development of its online platforms. This could solidify Reddit’s position at the forefront of online communities. On the other, the call for transparency and accountability in the eyes of shareholders could expose Reddit’s controversial content and loose moderating strategies, hence threatening the free-spirited essence of the platform which initially attracted its current user base.

Should Reddit decide to transition from a private to a publicly traded company, the platform will inherently face increased external scrutiny. This stems from the pressure to deliver consistent shareholder value. As a result, this could translate to Reddit making critical changes to its current operating model to suit investors. Such changes could include tighter content moderation policies, introducing premium access features and possibly even data sharing practices with third parties.

-

- Tighter content moderation can lead to censorship, thus alienating users that are drawn to Reddit’s current laissez-faire style of content moderation.

-

- Premium access features, if introduced, might deter casual users and shrink the current active user base.

-

- Data sharing with third parties is a slippery slope, as this can lead to backlash from users who value their privacy.

However, it’s not all doom and gloom. The potential for growth following an IPO is indisputable. For instance, the capital influx from the IPO could be used by Reddit to improve upon its existing infrastructure, hire additional staff, and venture into new, untapped markets. This could further solidify its position as a major player in the tech industry. In any case, the decision to go public is a significant one and not devoid of profound aspects influencing pre and post-IPO scenarios.

| Pre-IPO Scenario | Post-IPO Scenario |

|---|---|

| Private ownership with flexible structure | Public ownership with rigid structure |

| Loose content moderation | Tighter content moderation |

| Inherent freedom & leniency | Increased scrutiny & accountability |

An In-Depth Look at Reddit’s Financial Health Pre-IPO

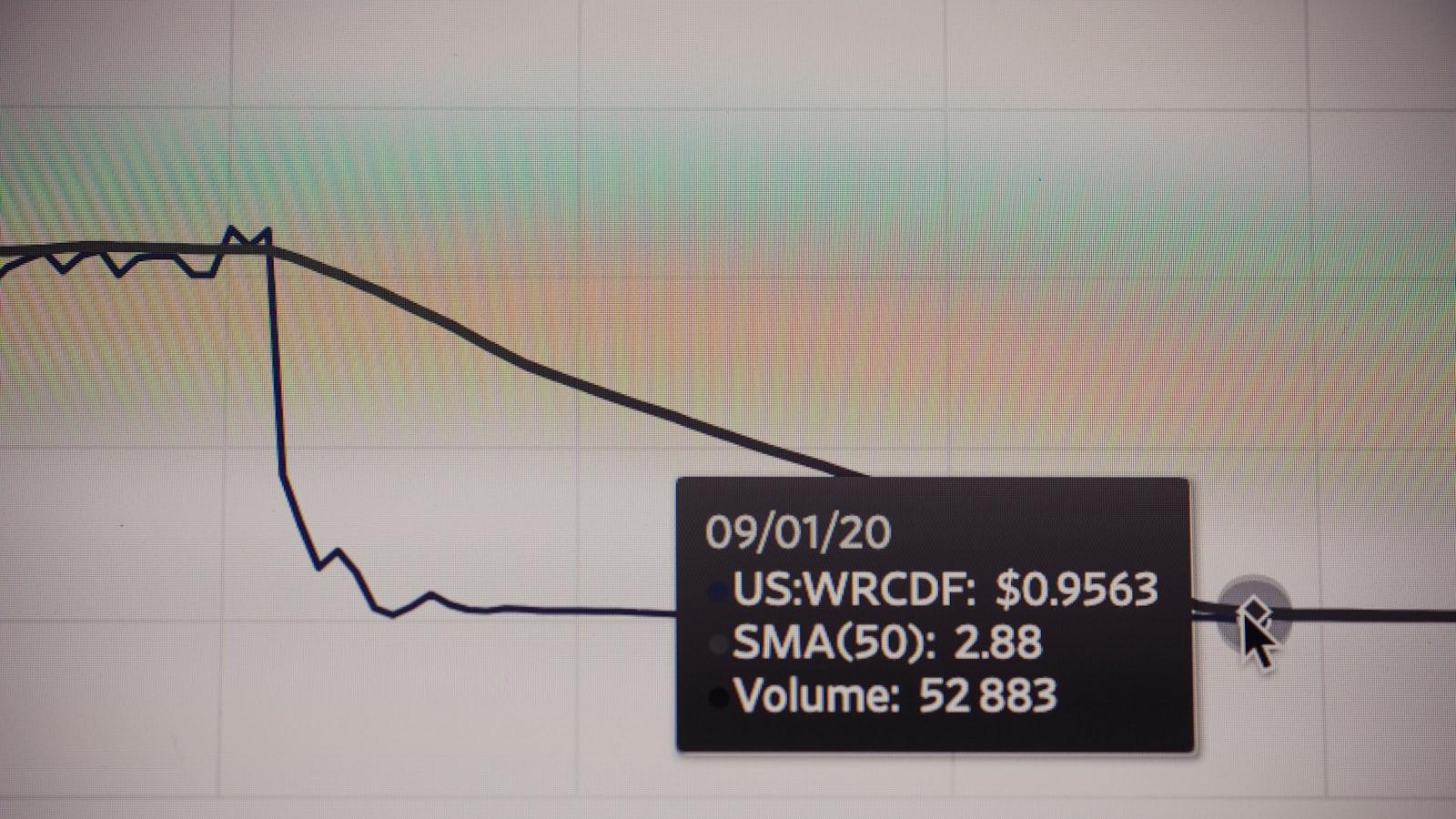

As one of the most popular social networking sites, with over 330 million monthly users, people are understandably curious about Reddit’s financial health before its impending IPO. From the outside looking in, Reddit seems in top shape. But does it have the potential to yield high returns like Facebook and Twitter after going public, or could it meet a similar fate as Snap Inc., which is currently struggling with users’ criticisms and financial woes?

When trying to predict the potential financial success of Reddit before going public, we must first understand Reddit’s revenue sources. Advertising and Reddit Gold are its primary income streams. Advertising on Reddit is relatively underpriced compared to other facebook-instagram-and-threads-are-coming-back-online-after-a-2-hour-outage/” title=”Facebook, Instagram, and Threads Are Coming Back Online After a 2-Hour Outage”>social media platforms, indicating significant room for growth. Reddit Gold, which is basically a $3.99/month or $29.99/year subscription offering members ad-free browsing and other perks, also contributes a modest amount to Reddit’s income.

However, the company has been tight-lipped concerning its financial matters. Increased transparency surrounding revenue and overall financial health would go a long way in boosting investor confidence—especially important considering the changing social media landscape and Reddit’s rapidly evolving user base.

Moving forward, the company appears to be expanding both its workforce and its focus on innovative advertising, which could potentially boost revenues post-IPO. But undoubtedly, the biggest issue looming for Reddit’s IPO is going to be valuation—you can’t ignore the fact that its recent $300 million funding round rocketed the company’s valuation to a whopping $3 billion.

| Company | Post-IPO Valuation | Current Market Cap |

|---|---|---|

| $104 billion | $844 billion | |

| $24 billion | $43 billion | |

| Snap Inc. | $28 billion | $22 billion |

This table illustrates the post-IPO valuation and current market capitalization for Facebook, Twitter, and Snap Inc. It might provide clues to how Reddit’s IPO might play out, along with the potential growth and risks associated with it.

Reddit’s IPO: Challenges on the Horizon

As the buzzing hive of conversation and content sharing that makes up Reddit moves toward an Initial Public Offering (IPO), speculations are rife about its survival capabilities. The disruptive ethos and open-door policy characterizing the platform pose significant challenges in the journey ahead. Will Reddit remain the so-called ‘front page of the internet’ or will it implode under the stress and criticism that often accompanies a public listing?

In the run-up to its IPO, Reddit must manage the transition from a passion-driven online community to a profitable, corporate-run entity. This process inevitably invites two main areas of contention: first, monetizing without compromising user experience, and second, navigating the complex landscape of digital rights and moderation.

-

- Reddit’s primary revenue driver is advertising. However, its undemanding ad model could likely face criticism from users who are not keen on intrusive or excessive advertising. Balancing the need for profitability with the platform’s core value of user-centric interaction will be a juggling act.

-

- Having positioned itself as an open platform for almost any kind of content, Reddit now grapples with the intricate challenge of content moderation. Ensuring the platform remains conducive for healthy discussions, while also addressing concerns over harassment, hate speech, and the proliferation of misinformation, is a precarious task.

Other concerns also stem from potential shifts in company culture post-IPO. A move towards a more revenue-focused strategy may change the dynamics of Reddit’s user and employee relationship fundamentally. In light of these potential stumbling blocks, a glance at Reddit’s financial vitals will provide some insight into the state of affairs.

| Reddit’s Reported Revenue | 2019 ($ Million) | 2020 (Estimated, $ Million) |

|---|---|---|

| Ad Revenue | 119 | 170 |

| Investments Raised | 300 | 250 |

| Valuation | 3,000 | 6,000 |

In conclusion, with diligent strategies, Reddit might just be able to overcome the impending challenges as it straddles the delicate line between profit and principle. The upcoming years would indeed tell whether Reddit can sustain its democracy in the face of capitalism or the newly-public company would fail to survive its own IPO.

Considering Community Reaction to Reddit’s IPO

The much-anticipated Initial Public Offering (IPO) of Reddit Inc. has evoked mixed reactions among the members of its diverse, worldwide community. While some Redditors express enthusiasm for the platform’s exponential growth and potential market success, others voice concerns about the possible changes that the IPO could bring to the platform.

The most fervent apprehension of the Reddit community revolves around the potential commercialization of content. The fear is that the dire pursuit of profitability could compromise the organic nature of Reddit’s content, potentially leading to an influx of advertisements and sponsored posts. Such a shift could disrupt the crucial sense of authenticity that underlines the platform’s popularity. These concerns are not unfounded, given the precedent set by other social media giants that started prioritizing commercial interests after going public.

| Community concerns | Potential impact |

|---|---|

| Increased Commercialization | Lower Engagement |

| Privacy Issues | User Attrition |

| Content Censorship | Community Fragmentation |

Another common worry raised by the community involves changes to Reddit’s user-friendly policies. For instance, concerns about potential increases in data mining and privacy violations were prevalent in many discussions. Users fear that post-IPO, Reddit might be pressured to monetize its twitter-chief-on-a-mission-to-purge-dating-apps/” title=”Yoel Roth, Twitter’s Former Trust and Safety Chief, Is Trying to Clean Up Your Dating Apps”>user data to meet revenue goals, a practice quite common among publicly traded tech companies.

Despite these concerns, there’s also a countering sentiment of optimism. Some believe that an influx of capital could help improve Reddit’s features and expand its user base. A section of the users seems willing to tolerate possible temporary inconveniences or changes for the long-run benefits. Furthermore, some even hope that the IPO could increase the platform’s legitimacy and reputation.

While predicting outcomes is tricky, it will be essential for Reddit to strike a balance between satisfying its public stakeholders and preserving the unique culture that has endeared it to millions globally. The community’s reaction underlines the centrality of this task, an aspect that could play a pivotal role in the success, or potentially, the failure of Reddit’s IPO.

Strategies for Reddit to Sustain and Thrive Post-IPO

As Reddit prepares for its Initial Public Offering (IPO), many users and investors are left questioning whether the platform can maintain its unique community-driven culture and still thrive in a competitive business landscape. However, with careful planning and strategic moves, Reddit can flourish post-IPO while staying true to its user-centric roots.

Firstly, it’s crucial that Reddit continues prioritizing user-generated content. This has been the lifeblood of the platform since inception, and any perceived shift away from it could alienate users who value Reddit’s democratic spirit. Keeping users at the forefront of strategy includes preserving subreddit autonomy, refuting pay-to-play accusations, and remaining transparent about data usage.

A second strategy could be the exploration and expansion to new markets. International growth can be instrumental in the quest to increase profitability. Countries like India, Brazil, and South Korea have significant mobile tech-savvy populations who could potentially be the next wave of Redditors. Moreover, Reddit could also contemplate adding features and services to its already vast platform, pulling inspiration from successful expansions by fellow tech companies. Concepts such as premium subscriptions, sole content creators synergies, and eCommerce integrations are all worth considering.

| Strategy | Potential Benefits |

|---|---|

| User-generated Content | Maintain User Loyalty, Increase Engagement |

| International Expansion | Increased User Base, Higher Revenue |

| New Services/Features | Diversified Revenue Streams, Enhanced User Experience |

Last but not least, Reddit needs to prioritize platform safety and integrity. There has been a rise in public scrutiny regarding hate speech and misinformation on social media. By adopting tougher measures to combat such issues, Reddit could potentially attract a more diverse audience, while keeping the platform a safe space for constructive dialogue.

The path to post-IPO growth and sustainability is not easy, and it comes with its set of complexities. Nevertheless, by focusing on these strategies, Reddit stands a promising chance of remaining a beloved digital destination while entering a new epoch of growth and profitability.

The Conclusion

In conclusion, the looming possibility of a Reddit IPO raises valid concerns about the platform’s future. As Reddit continues to evolve and navigate the complexities of monetization, it will be fascinating to see how it navigates the challenges ahead. Only time will tell if Reddit can thrive under the scrutiny and demands of public ownership. Let us continue to watch this space with curiosity and anticipation.