In the world of cryptocurrency, few things capture the attention of investors and analysts quite like a sudden surge in the price of Bitcoin. As the value of the digital currency continues to climb, many are left wondering: what exactly is fueling this latest spike? While some may attribute it to market trends or financial indicators, the truth may actually lie closer to home – in the realm of human emotion and collective feelings. Yes, you read that right. In this article, we’ll explore the intriguing concept of vibes and how they could be playing a major role in the recent Bitcoin price surge. Strap in, as we dive into the fascinating world of crypto and the power of vibes.

Table of Contents

- Factors Contributing to Bitcoin’s Price Surge

- Psychological Factors Playing a Key Role

- The Impact of Market Sentiment on Bitcoin Prices

- Recommendations for Investors During Price Surges

- To Wrap It Up

Factors Contributing to Bitcoin’s Price Surge

One of the key factors contributing to the recent surge in Bitcoin’s price is the overall positive sentiment surrounding the cryptocurrency. As more investors become interested in Bitcoin, the general vibe in the market has shifted to one of excitement and optimism. This positive energy has helped to drive up demand for Bitcoin, ultimately pushing its price higher.

Another factor behind Bitcoin’s price surge is the increasing institutional adoption of the cryptocurrency. Big players in the financial industry, such as Tesla and PayPal, have publicly endorsed Bitcoin, leading to greater credibility and acceptance among mainstream investors. This institutional support has boosted confidence in Bitcoin as a legitimate asset, driving up demand and pushing prices higher.

Additionally, the scarcity of Bitcoin plays a significant role in its price surge. With a limited supply of 21 million coins, scarcity has always been a defining feature of Bitcoin. As more people buy into the cryptocurrency, the limited supply can create a sense of urgency, driving up prices as demand outstrips supply. This scarcity factor has been a key driver of Bitcoin’s price surge in recent months.

Lastly, the macroeconomic environment has also contributed to Bitcoin’s price surge. With central banks around the world printing trillions of dollars in response to the COVID-19 pandemic, investors are increasingly turning to alternative assets like Bitcoin as a hedge against inflation. This flight to safety has driven up demand for Bitcoin, leading to its recent price surge.

Psychological Factors Playing a Key Role

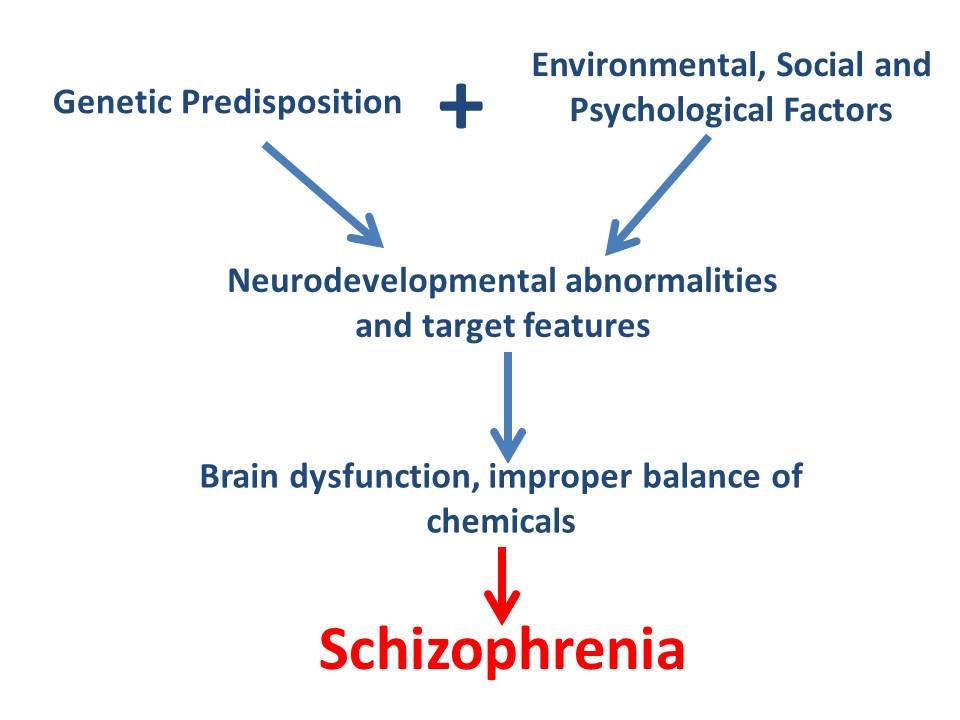

It’s no secret that the world of cryptocurrency is driven by more than just market trends and financial analysis. Psychological factors play a significant role in the fluctuations of Bitcoin prices, often contributing to sudden surges or drops that seem to defy traditional logic.

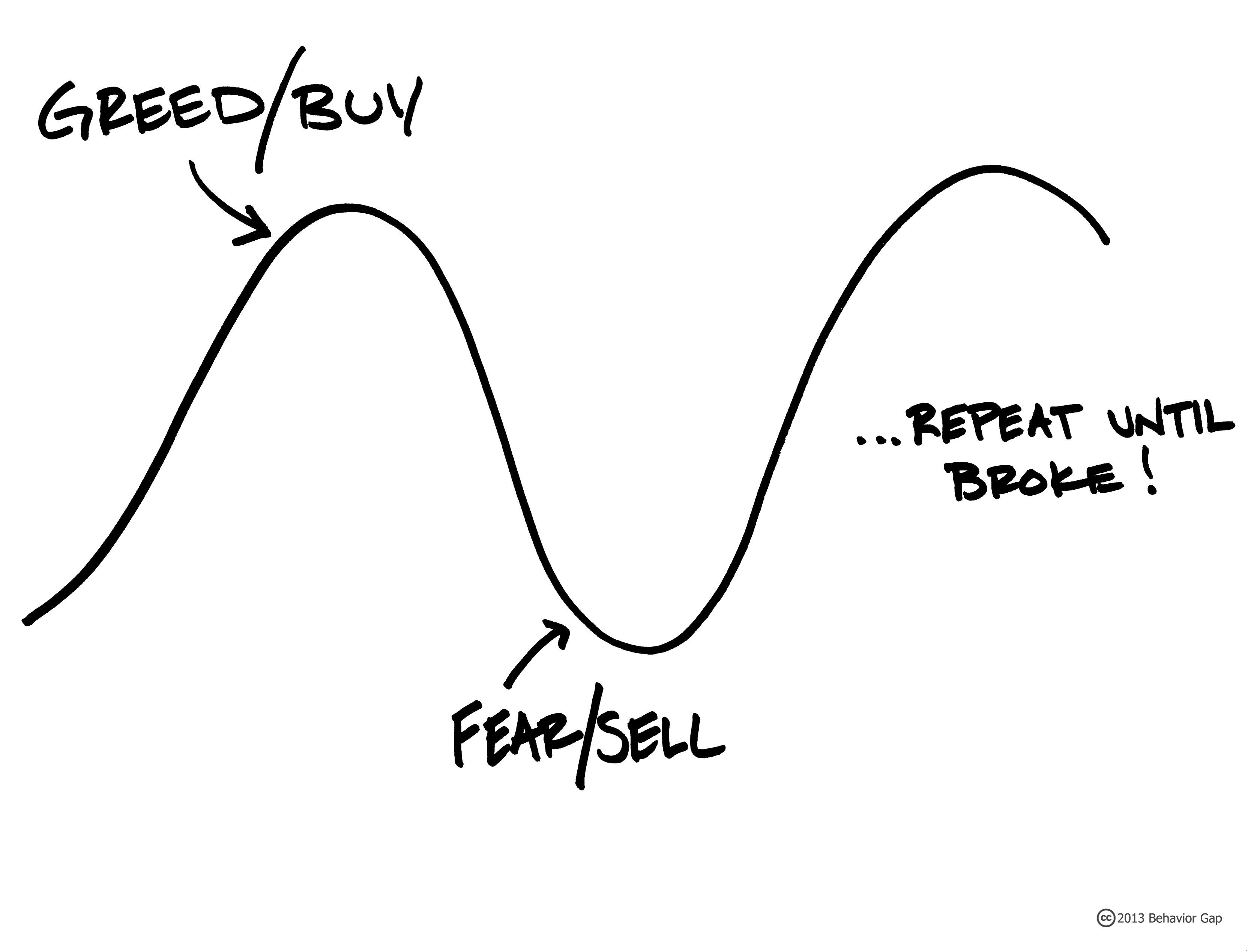

One of the key psychological factors at play in the recent Bitcoin price surge is sentiment. Positive sentiment among investors can create a sense of FOMO (fear of missing out), leading to increased buying activity and driving prices up. Similarly, negative sentiment can cause panic selling and sharp price drops.

Market psychology also plays a vital role in driving Bitcoin prices. Traders’ emotions, biases, and herd mentality can all influence the market in ways that are not always rational. Understanding and analyzing these psychological dynamics can provide valuable insights into the behavior of Bitcoin prices.

In conclusion, while technical analysis and market fundamentals are crucial in understanding the world of cryptocurrency, we must not underestimate the power of psychological factors in driving Bitcoin prices. By recognizing and taking into account the emotional and behavioral aspects of the market, investors can gain a deeper understanding of the forces at play and make more informed decisions.

The Impact of Market Sentiment on Bitcoin Prices

When it comes to the wild world of Bitcoin prices, it’s not just about numbers and charts. Market sentiment plays a crucial role in determining the ups and downs of the cryptocurrency. The overall feeling within the cryptocurrency community can heavily influence whether prices skyrocket or plummet.

Positive vibes can lead to a surge in Bitcoin prices as investors feel bullish and confident about the future of the digital currency. On the flip side, negative sentiment can cause prices to drop as fear and uncertainty grip the market. It’s almost like a self-fulfilling prophecy – if enough people believe Bitcoin will rise, it likely will.

Factors such as news events, social media chatter, and even celebrity endorsements can all impact market sentiment. A positive tweet from Elon Musk, for example, can send prices soaring, while regulatory crackdowns can send them tumbling. It’s a delicate balance that can be easily swayed by external forces.

For traders and investors, understanding and analyzing market sentiment is crucial for making informed decisions. By keeping a pulse on the overall vibe surrounding Bitcoin, they can better predict price movements and capitalize on opportunities in the ever-changing landscape of cryptocurrency.

Recommendations for Investors During Price Surges

With the recent surge in Bitcoin prices, investors are left wondering what is driving this upward momentum. While there are always various factors at play in the volatile world of cryptocurrency, it seems that this time around, positive vibes are mostly responsible for the price surge. The general sentiment surrounding Bitcoin has been extremely positive, with increased interest from institutional investors and growing adoption by mainstream companies.

During times of price surges, it is important for investors to remain cautious and not get carried away by the hype. Here are some recommendations for investors to consider:

-

- Diversify your investment portfolio: It’s always a good idea to spread your investments across different assets to minimize risk.

-

- Do your research: Before making any investment decisions, make sure to do thorough research on the cryptocurrency market and the specific assets you are interested in.

-

- Set realistic goals: Don’t let FOMO (fear of missing out) dictate your investment strategy. Set realistic goals and stick to your plan.

-

- Stay informed: Keep yourself updated on the latest news and developments in the cryptocurrency space to make informed decisions.

By following these recommendations, investors can navigate through price surges with confidence and make sound investment decisions in the ever-changing world of cryptocurrency.

To Wrap It Up

As the Bitcoin price continues to surge, it’s clear that there are a myriad of factors at play. Whether it’s positive vibes and sentiment driving the market, institutional adoption, or simply the natural ebb and flow of the cryptocurrency world, one thing remains certain – Bitcoin’s price is always a topic of intrigue and speculation. As we navigate this ever-evolving landscape, one thing is for certain – the only constant in the world of cryptocurrency is change. Stay tuned and stay curious as we continue to unravel the mysteries behind the Bitcoin price surge.